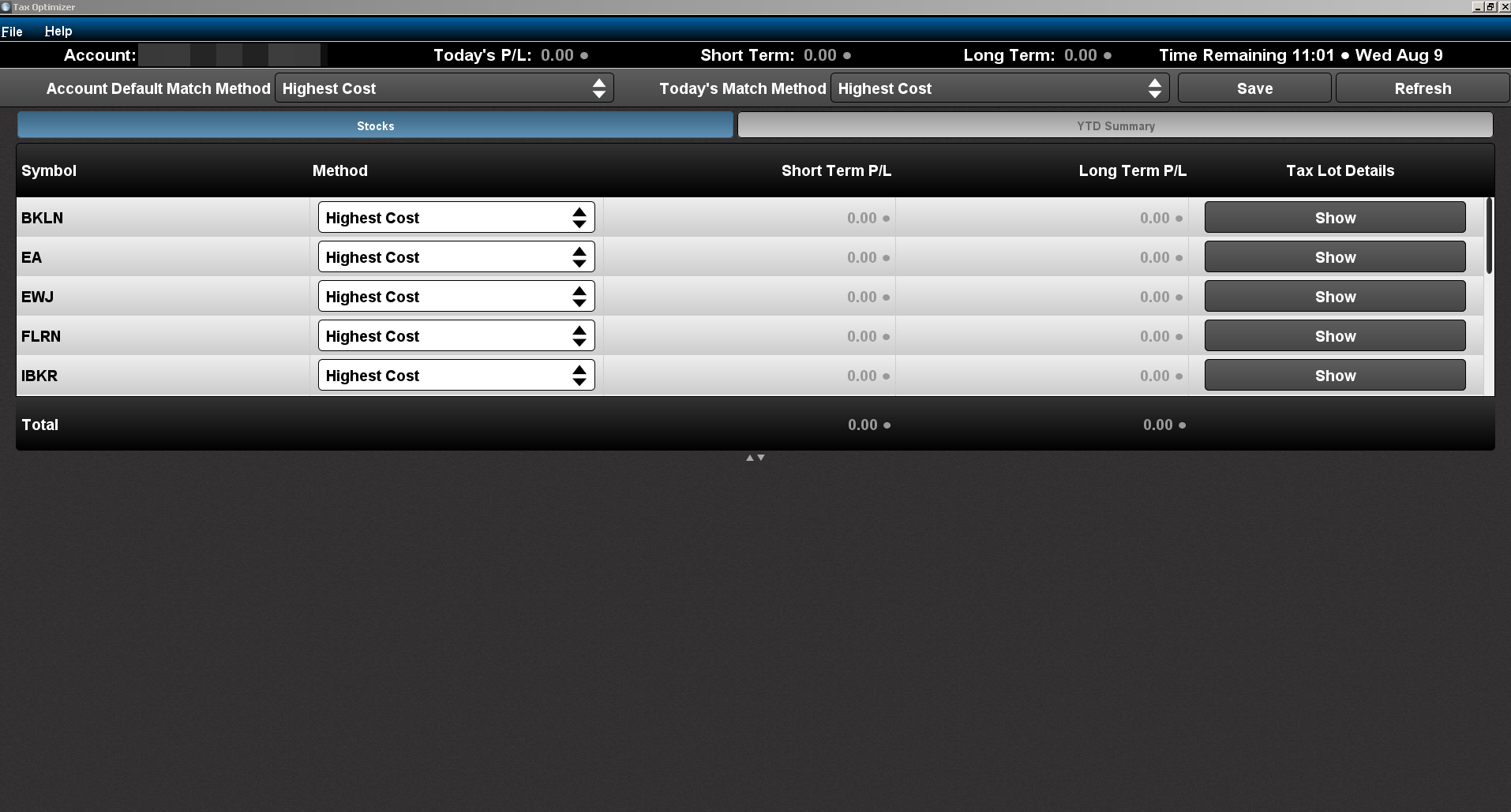

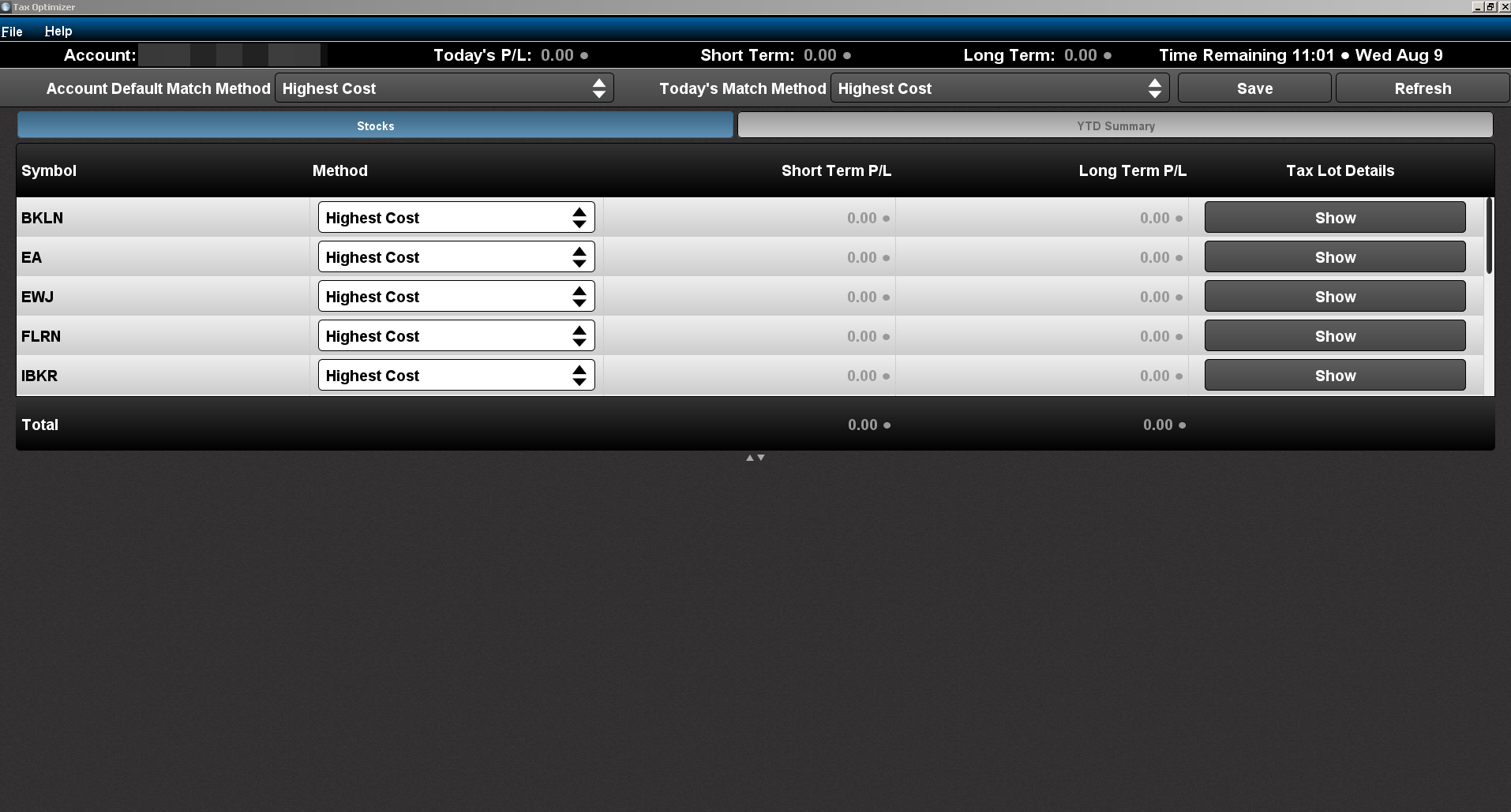

The Tax Optimizer is a tool available within Account Management that lets you manage your stock, option, bond, warrant, single-stock future and mutual fund gains and losses for tax purposes.

Specifically, the Tax Optimizer lets you select one of several tax lot-matching methods to:

Futures (but not Single Stock Futures) and options on futures always use FIFO.

In addition, you can view a year-to-date (YTD) summary screen, which shows your YTD short-term and long-term profit and loss, unrealized profit and loss, and total profit and loss by symbol. You can change your account default lot-matching method and today's lot-matching method from the YTD summary.

All profit and loss amounts in the Tax Optimizer are converted to the base currency of your account. However, prices are NOT converted to your base currency.

The Tax Basis Declaration page, available in the reporting section of Account Management, lets you change the default tax lot-matching method for your account. This function in the Tax Optimizer replaces the same function on the Tax Basis Declaration page, so you will no longer have access to the Tax Basis Declaration page in Account Management. You will be able to change the default tax-lot matching method on the Tax Optimizer page in Account Management OR in the Tax Optimizer.

For more information