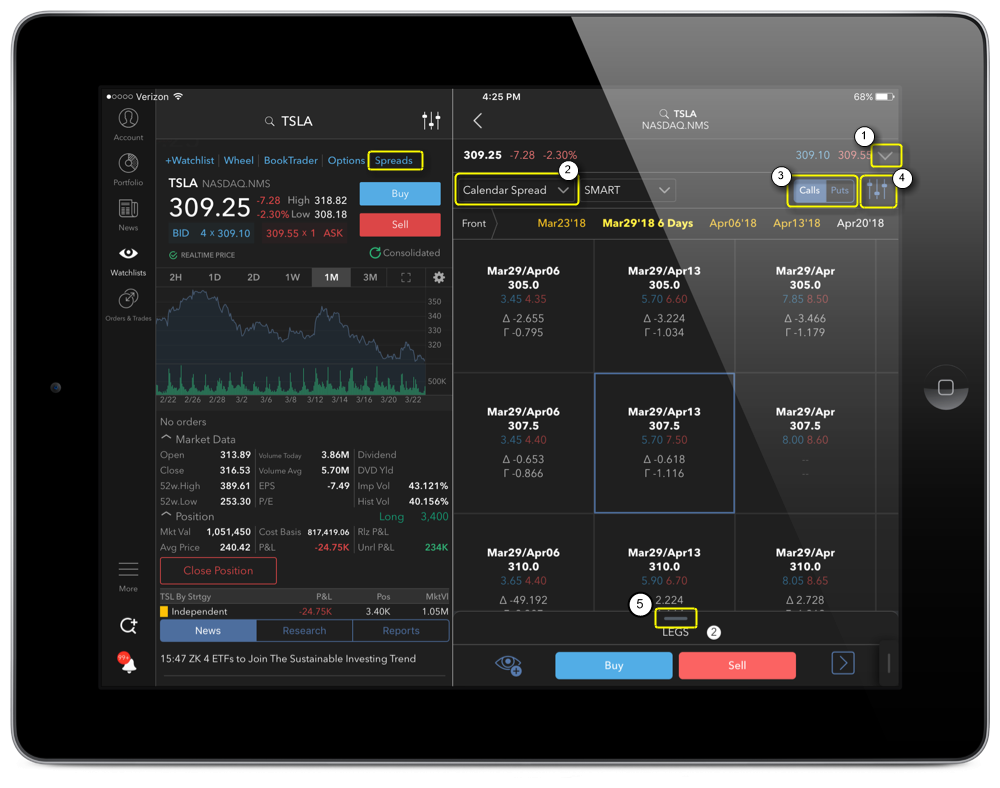

Open details for an instrument (tap the instrument twice from a Watchlist) then tap “Spreads” from the top row of action buttons.

Note: Alternatively, you can select "Spread Template" from the instrument type list when adding an asset to your Watchlist.

-

Using the drop-down list (

in bottom image) at the top of the Spread Template, select a strategy (Calendar, Vertical, Diagonal).

in bottom image) at the top of the Spread Template, select a strategy (Calendar, Vertical, Diagonal). - Choose "Calls" or "Puts" (

in bottom image) and if needed, define data filters or filter out weekly contracts (

in bottom image) and if needed, define data filters or filter out weekly contracts ( in bottom image).

in bottom image).

Tap a box to add the strategy to the Strategy Builder below the grid. Gamma and Delta are shown along with the combo premium, and these values update automatically if you edit the strategy.

Note: If you don't see the Strategy Builder, tap and drag the horizontal line above "LEGS" to view. ( in below image).

in below image).

Add to your Watchlist

Add to your Watchlist

Trade the spread

Trade the spread

Open the Instrument Details window for the strategy

Open the Instrument Details window for the strategy

Tap the "down" arrow to view more data, then swipe right-to-left to view all columns.

Tap the "down" arrow to view more data, then swipe right-to-left to view all columns.